Thursday May 4, 2023

The Benefit of Adding Financial Wellness to Your Organization

Employers are accustomed to offering benefit packages designed to help their workers stay healthy, including health insurance and wellness programs. And they’ve traditionally provided support for their retirement, either through pensions or access to a 401(k) plan. But a new, fast-growing concept of financial wellness brings those concepts together, helping workers manage their personal finances and plan their fiscal future.

The idea has taken off in recent years, with 59% of employers surveyed by Aon Hewitt saying they are likely to focus on the financial well-being of their workers in 2021; that’s almost twice as many as said they would in 2017 (30%). For these employers, financial wellness goes beyond helping with strategies to save for retirement. They’re helping workers budget their money, grow everyday savings and better manage their credit.

Financial wellness often fits into an employer’s larger strategic goals around their workforce’s physical and mental well-being.

Learn more about

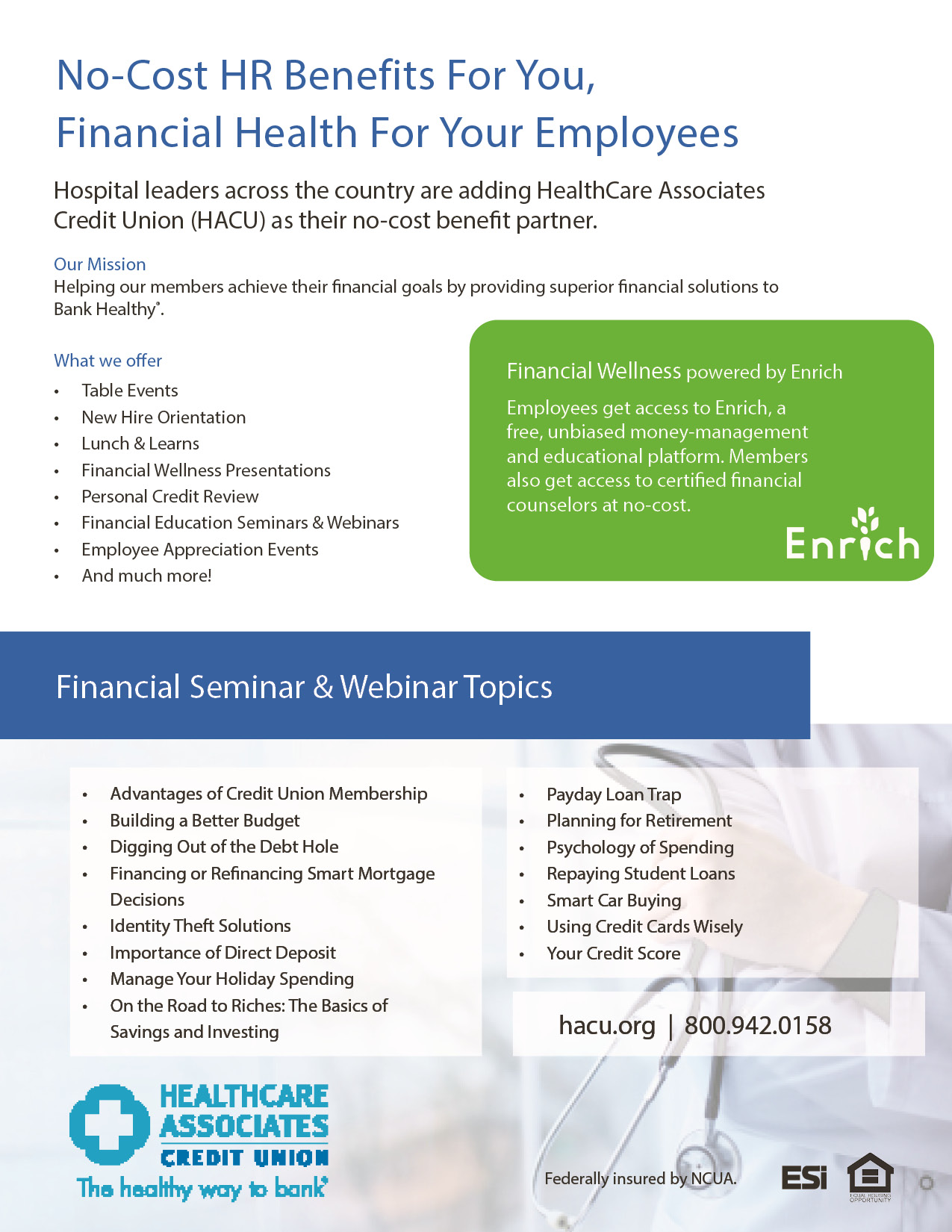

No-Cost HR Benefits for You, Financial Health for Your Employees

Organizations’ approach to both financial and physical well-being

- Financial wellness incorporated in physical health strategic pillar: 41%

- Separate financial and physical well-being approaches: 46%

- Physical well-being initiative but no financial one: 31%

- Have financial well-being strategy but no physical well-being one: 6%

Source: Aon Hewitt 2021 survey

What kinds of financial wellness services are they offering?

- Basics of financial markets: 48%

- Health care education and planning: 42%

- Financial planning: 38%

- Budgeting: 38%

- Prioritizing savings: 31%

- Debt management: 29%

- Saving for life stages: 27%

Source: Aon Hewitt 2021 survey

Employers are adding financial wellness as a benefit; here’s why

Employers are recognizing that financial stress is a problem for many Americans, and that stress can get in the way of their workdays. Helping their employees deal with their day-to-day finances as well as planning for the future can also build loyalty with the employer, according to the 2021 version of an annual survey conducted by Aon Hewitt.

With five generations already employed in the workforce and more Gen Zers joining in droves to fill healthcare jobs, HR departments are keeping a keen focus on how their employees see the world, and the values they hold. Young people encounter their finances on a smart phone screen but don’t necessarily understand the depth behind the numbers, which tends to distance them from the realities of dollars and cents,” says Joe Kregul, HACU President and CEO. “Recent graduates of high school and college bound students will get approved for a credit card and don’t truly comprehend the complexities or impact of using it. Sometimes they don’t understand that its essentially a loan,” Kregul says. “Even business savvy individuals may not know the financial basics of budgeting, credit or what factors affect a credit score. HACU is there to help, credit unions are founded on the principal of people helping people and that’s what we look to do.”

Why are employers interested in workers’ financial wellness?

- It’s the “right thing to do”: 84%

- Improve employee engagement: 78%

- Improve retirement statistics: 60%

- Decrease employee time spent addressing finances: 57%

- Decrease medical costs: 37%

- Employees are asking for it: 36%

Source: Aon Hewitt 2021 survey

Employees value financial wellness services—but many don’t know if they are offered

Is it important for your employer to offer financial wellness services?

- Yes: 89%

- No: 11%

If your company offered resources for you to plan for [your] financial future[,] would you use them?

- Yes: 80%

- No: 20%

Does your company offer a financial wellness program?

- Yes: 46%

- No: 29%

- Not sure: 25%

Source: “What your employees think about financial wellness programs,” Jellyvision (2022)

Finances, stress and work

- Eight of 10 American workers say their most common cause of stress is financial.

Source: “Stress in America: Are Teens Adopting Adults’ Stress Habits?” American Psychological Association, (2022) - 34% of employees say that personal finances have been a distraction at work

- 47% of millennial workers say their personal finances are a distraction at work

- 49% of those who are distracted by their finances at work say they spend three hours or more each week thinking about or dealing with financial issues

Source: PWC employee financial wellness survey, 2022 results

What are employees stressed about?

- Not having emergency savings for unexpected expenses: 55%

- Unable to retire when want to: 37%

- Unable to meet monthly expenses: 25%

- Being laid off: 20%

- Unable to keep up with debts: 15%

- Unable to pay for college: 5%

- Losing my home: 5%

Source: PWC employee financial wellness survey, 2022 results

Financial wellness for employers in health care

Healthcare employers that want to offer financial wellness services as a benefit need to be prepared to respond to a wide range of needs, ages and incomes.

Employees of any income can encounter a financial crisis and need money fast. Sometimes they’ll consider borrowing from a retirement fund, which is not ideal either because of penalties and because of the prospect of setting back savings goals.

Hospitals also employ many people with much lower incomes, for whom a money crunch can be devastating. Careful management of dollars for those people is particularly important for their stability and ability to stay on the job, notes Farrere. Financial wellness programs can provide help with budgeting, saving and spending so they not only manage day-to-day but can also plan for retirement.

Student loans an increasing source of concern

Employees with a student loan:

- Generation Z: 68%

- Millennials: 42%

- Gen X: 26%

- Baby Boomers: 11%

Of those with student loans, the percentage saying they have a moderate or significant impact on their ability to meet other financial goals:

- Generation Z: 98%

- Millennials: 79%

- Gen X: 66%

- Baby boomers: 80%

Source: PWC employee financial wellness survey, 2022 results

Many employer programs may use “scary” language, turning off potential users

I wish the financial resources my company provided used friendlier language:

- Strongly agree: 36%

- Somewhat agree: 30%

- Somewhat disagree: 28%

- Strongly disagree: 6%

Younger workers are most likely to be intimidated by their employer’s financial wellness program (49% of those 18–34) compared with older adults (19% of those 50 and older).

Words that make employees tune out:

- “Spending habits” (39%)

- “Living within your means” (27%)

- “Estate planning” (22%)

Language that encourages employees to take action:

- “Planning for retirement” 59%

- “Planning for your financial future” (50%)

- “Managing your savings” (50%)

Source: “What your employees think about financial wellness programs,” Jellyvision (2022)

At the same time, half the workforce is of an age where retirement is becoming more real. employers feel a responsibility to take care of loyal employees, particularly those with relatively low-paying jobs such as food service or transportation.

Recognizing that long-term planning is an abstraction for most people, many organizations are going above and beyond to ensure each employee understands their total rewards package. With the understanding of the total cost employers are paying by way of benefits and employer sponsored matches, employees know that their compensation goes beyond the paycheck they receive. All the health system’s financial wellness benefits are meant to deliver the message that the employer is looking out for its employees.

How generations differ on financial concerns

What would most help you achieve your future financial goals?

Baby boomers:

- Lower healthcare costs (26%)

- Rising stock market (43%)

- Lower inflation (22%)

Millennials:

- Better job security (37%)

- Lower health care costs (29%)

- Lower inflation (47%)

Source: PWC employee financial wellness survey, 2022 results

Millennials increasingly worried about money

PWC’s survey found a rising level of worry about finances among millennial employees over the past few years. Percentage of millennials reporting that their stress level related to financial issues increased over the past 12 months:

- • 2019: 49%

• 2020: 68%

• 2021: 72%

• 2022: 84%

It’s important to add people strategies focused on ways the hospital can recruit and retain the workforce it needs. The competitive nature of healthcare environment today has put a lot of pressure on the HR staff to keep benefit offerings as attractive as possible.

Financial wellness has been an important component of the overall wellness approach the hospital is using to make it a good place to work. In conclusion, Human Resources is constantly evolving, but one thing is certain, a well-rounded benefit plan not only addresses the employees physical health, but also their fiscal health.

To learn more about HealthCare Associates Credit Union comprehensive no-cost offering, visit www.hacu.org.